The Global Awakening of Cannabis: Between Regulatory Maturity and Business Imperative

Mature regulation, institutional capital, and patient focus reshape the future of the global medicinal cannabis market

Published at 02/03/2026The global medicinal cannabis market is going through a moment of greater structural transformation. What was once a discussion guided by activism and legal uncertainty is now driven by robust clinical data, macroeconomic pressures, and an unprecedented geopolitical restructuring. For decision-makers in the sector, the scenario demands a strategic reading: regulation has finally started to catch up with pent-up demand, but business success now depends on the ability to put the patient at the center of the value chain.

The New Brazilian Framework: The Evolution of RDC 327 and Sector Numbers

In Brazil, the recent revision of RDC 327 by Anvisa (announced in January 2026) is not just a bureaucratic adjustment; it is a sign of institutional maturity. By simplifying renewal procedures and allowing compounding pharmacies to enter the game, the agency provides the predictability needed for long-term planning.

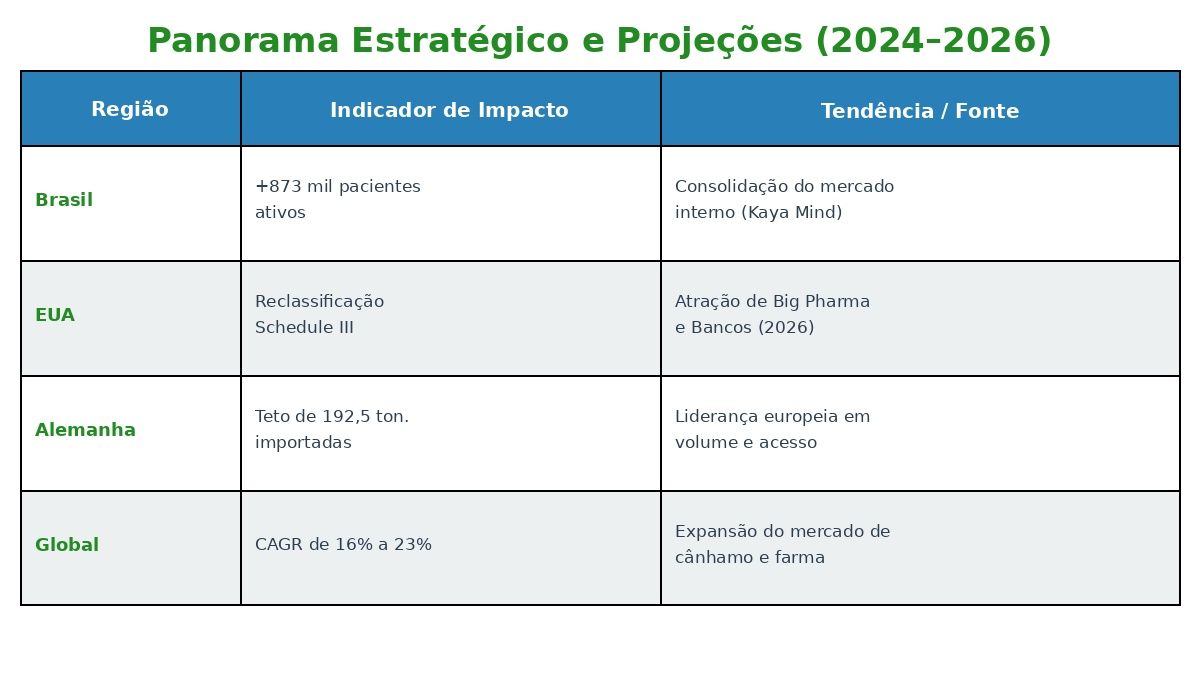

From a business perspective, the numbers are impressive. According to Kaya Mind's 2025 Medicinal Cannabis Yearbook, Brazil ended the last year with around 873 thousand patients in treatment, a significant jump from the 672 thousand recorded in 2024. The sector's revenue in the country is already flirting with the historic mark of R$ 1 billion, consolidating Brazil as the main hub in Latin America. Projections from Grand View Research indicate that by 2030, the Brazilian market should maintain a Compound Annual Growth Rate (CAGR) of 26%, reaching figures that justify the heavy investments in infrastructure and logistics seen in recent months.

The Turn of Powers: USA and Institutional Capital

While Brazil refines its rules, the international chessboard moves at an accelerated pace. In the United States, the reclassification of cannabis to "Schedule III" and the imminent executive order to facilitate scientific research change the rules of the game. For the market, this represents the removal of the tax barrier (the dreaded Article 280E of the US tax code), allowing companies to finally deduct operational expenses and drastically improving cash flow.

This change opens the floodgates for institutional capital. With cannabis moving out of the same category as heroin to become a federally recognized medicinal substance, the American market is projected to reach $47 billion in 2026. For Brazilian investors, this signals an era of scientific validation that will facilitate local medical acceptance and reduce market education costs.

Germany: The European Access Model

In Europe, Germany has established itself as the continent's engine after the full implementation of the CanG law. By removing cannabis from the list of narcotics, the German government eliminated the bureaucratic stigma that hindered prescriptions. In 2025, the country recorded import records, adjusting its annual ceiling to 192.5 tons to avoid shortages. Germany sets the trend: the market is not just about the product, but about the robustness of the supply chain and regulatory efficiency.

Profit in Purpose: The Patient as Central Asset

Despite the billion-dollar projections, there is a latent strategic risk: the gap between financial spreadsheets and clinical need. In the cannabis sector, a company's value will not only be measured by its market cap but also by its ability to generate real therapeutic outcomes.

We need to give patients all the benefits that this plant can offer. This is not just an ethical flag; it is a smart business strategy. The financial sustainability of the sector depends on recurrence, and recurrence depends on effectiveness and cost-effectiveness. The investor who ignores access barriers (price and bureaucracy) is investing in a glass ceiling.

Conclusion

We are closing the speculative "gold rush" phase and entering the era of professional consolidation. With Anvisa releasing cultivation for research and facilitating dispensing, the USA validating science, and Germany democratizing access, the path is paved.

The challenge now is operational: to build an ecosystem where the patient receives the best the plant has to offer, with the efficiency that only a free and regulated market can provide.

The author's opinion does not necessarily reflect the opinion of the Sechat portal.

Tiago Zamponi is a lawyer specialized in business development, sales, and strategic planning. He currently resides in Canada where he works as the General Manager LATAM of Conversance, a company focused on creating a Blockchain Markets, supply, procurement, quality management, and logistical support for the safe movement of medicinal cannabis between licensed parties worldwide.